Change Employee Tax Information

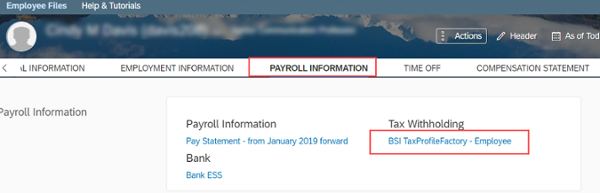

Employees who are U.S. citizens or Lawful Permanent Residents can update their federal and state withholding s tax forms via Payroll Information within their Employee Profile in SuccessFactors. The BSI TaxProfleFactory – Employee link displays current information and provides directions to update the forms.

Employees who are international (includes Aliens Authorized to work) will NOT use the BSI Tax Factory tool, but submit all tax withholding documents via the Glacier software entries and documents sent to the Nonresident Tax Administrator.

Publication 15-T lists current Federal Tax Withholding rates and tables and Indiana Departmental Notice #1 displays Indiana county tax rates for withholding. IRS information for international employees is located online at https://www.irs.gov/individuals/international-taxpayers.

Additional Resources

- Review Tax Withholding Information online to learn more about federal, state and county tax withholding.

- Visit International Students and Scholars online at https://www.purdue.edu/IPPU/ISS/.

- Visit IRS Publications to view additional information on 576, 17 and 970.

- Other tax forms:

|

Certificate of Residence - For Reciprocal States: Michigan, Ohio, Pennsylvania, Kentucky, and Wisconsin (Excel File) |

|

|

Cancellation of Reciprocal Exemption From Withholding of Indiana Adjusted Gross Income Tax (Excel File) |

Fellowships

Please visit the Fellowship Office of the Graduate School to learn more about fellows and tax implications. Additional information about the taxability of fellowships is provided in Internal Revenue Service Publication 970, Tax Benefits for Education .Please consider the following:

- For U.S. persons, it is the taxpayer’s responsibility to report taxable fellowships. A fellowship statement is provided.

- For Nonresident Aliens, it is the responsibility of Purdue to report taxable and nontaxable amounts of fellowships. Please print 1042S from Glacier.