SuccessFactors Frequently Asked Questions (FAQs)

W-2 Services are provided by ADP.

Employees with a hire date after January 1, 2024

Registering for online W-2 access with ADP is easy through SuccessFactors. Locate the W-2 Services Registration PDF under the 'View Company Documents' Quick Action tile for instructions on how to register for your W-2 online. The registration code is found in the QRG. You will also need your PUID, valid SSN and last ZIP code from your address on file.

- Please review Data Security and Privacy at ADP.

- You may register at anytime to create an account to view or print the current year's W-2 and the prior two years' past forms.

- Register by December 31 of the current calendar year to opt out of a mailed W-2 copy for the current tax year's form.

- W-2 forms prior to the current year's plus two years prior must be requested by completing the Duplicate Tax Request Form and sending via mail or fax to Purdue University Tax Department, 2550 Northwestern Ave., Ste. 1100, West Lafayette, IN 47906. Please do not email the form as it contains your Social Security Number.

Questions can be sent to tax@purdue.edu.

Employees hired prior to January 1, 2024,

Employees who previously accessed ADP for timekeeping can use the ADP tile within the SuccessFactors homepage for W-2 Services and view past pay statements prior to January 1, 2024.

If any errors are encountered with the ADP W-2 Services tile, please follow below instructions for those employees hired after January 1, 2024.

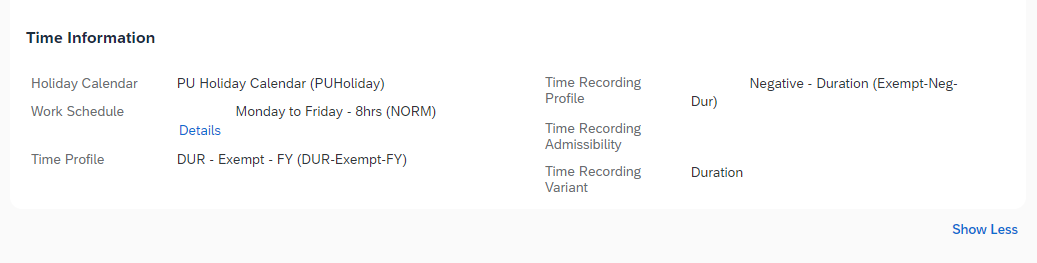

Access My Profile in SuccessFactors. Navigate to the Job Info - Job Information tab. Locate Time Information. Time Recording Profile is displayed as well as work schedule. Contact Human Resources or timeadmin@purdue.edu for additional assistance.