iWorkGlobal

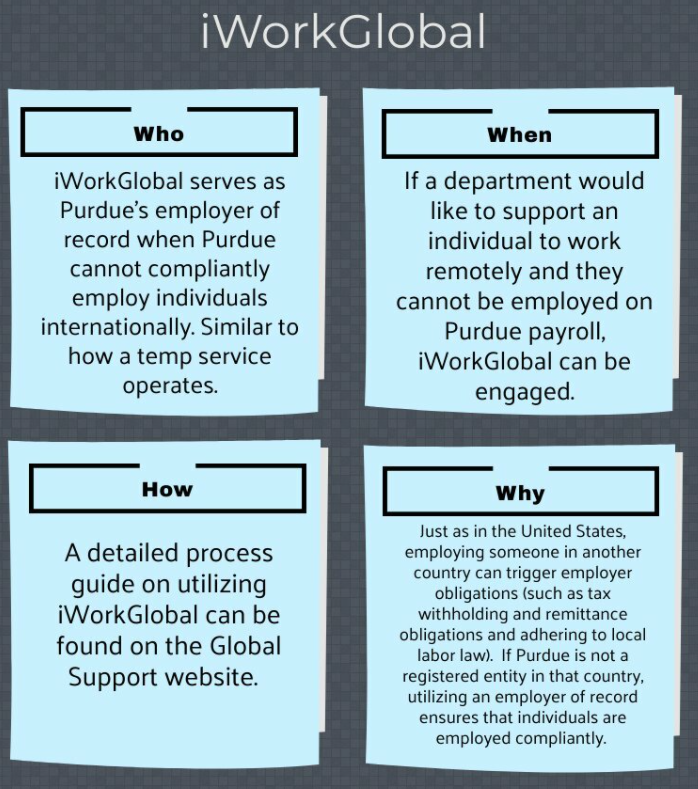

iWorkGlobal is Purdue’s preferred partner for International Employer of Record services and functions similarly to how Purdue’s partnership with Knowledge Services works. iWorkGlobal employs the individual directly, assigns their services back to Purdue, and is responsible for maintaining all employment compliance in country (ranging from onboarding, fringes and taxes, and offboarding). This option can bridge the compliance challenges of employing individuals internationally, while also permitting the programmatic work to continue.

Costs: There are overhead costs associated with this choice that are borne by the department. The costs are unique to each situation and country and include: employer burden (adhering to statutory minimums in country), overhead costs (iWorkGlobal’s fee) and some countries have Value Added Tax costs as well.

How to initiate the process: To obtain more information or request a quote, please complete the following information and send it to globalservices@purdue.edu. In order to obtain a quote, please include the following information on the inquiry:

- Name:

- Position:

- Citizenship:

- Country the employee will be employed in:

- Providence or Region of foreign country, if applicable:

- Monthly Pay rate:

- AY or FY:

- Hours worked per week:

- Dates of employment in country:

A Change of Duty Station Request should still be filed for this option to ensure the right Purdue individuals are included. Please include a comment on the Change of Duty Station request that the individual will be employed by iWorkGlobal.

Part of fulfilling the requirements of a Purdue offer letter is to be able to be employed in the United States. Employing someone from an international location is not always an approvable arrangement and has many moving parts. As always required for individuals requesting to perform work remotely from an international location, a Change of Duty request must be submitted. This ensures the appropriate programmatic and central approvers are engaged. If determined keeping the individual on Purdue payroll is not compliant, employing them through iWorkGlobal may be considered along with other options.

When employing someone to work remotely from an international location, there are many considerations. Employing someone to work in an international location can trigger tax-withholding obligations for Purdue as their employer in the foreign country. If Purdue is not a registered entity in that country, Purdue cannot properly withhold and remit the taxes as required. In addition to tax requirements, the employer may also have to adhere to other HR regulations (such as remitting payment in local currency, country specific reporting obligations, or participating in local healthcare). Additionally, this can trigger Export Control licenses or other requirements that need to be approved prior to initiating work in the foreign location. It is important to keep in mind that these are not internal Purdue policies but rather as the employer, Purdue has to adhere to both U.S. laws and the laws of the country the individual is employed in.